Sales volume growth and production efficiency helped Betagro offset pricing challenges and post strong Q3 results.

Thailand’s agrifood company Betagro reported a net profit of around USD 36 million in Q3 2025, an increase of 19.1% year-on-year (yoy). The company’s net profit margin reached 3.8%, reflecting improved operational efficiency and stronger gross margins.

The increase was mainly attributable to better cost control and a strategic focus on high-margin products. This helped offset pressure from declining pork prices.

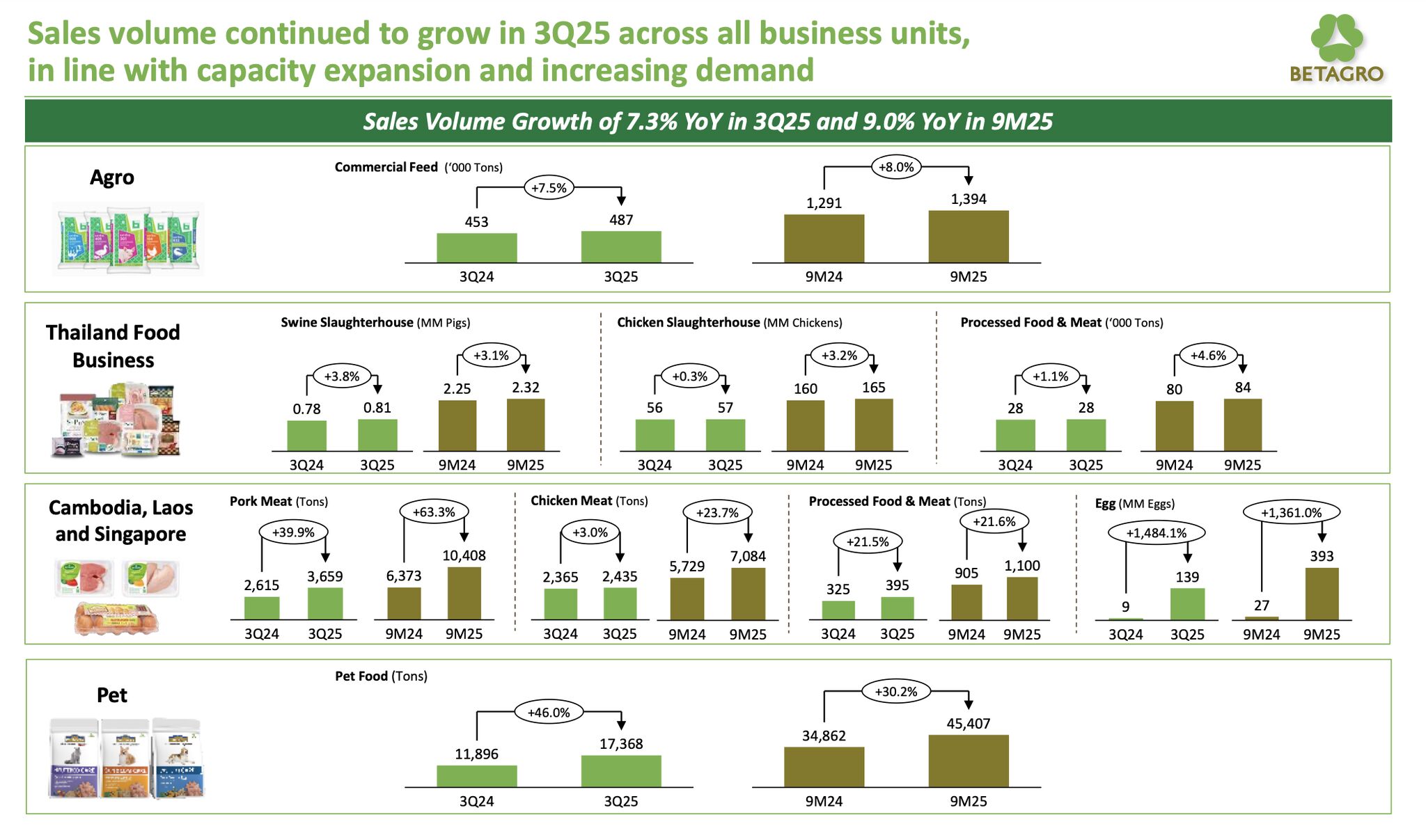

Sales volume growth offsets price declines

Total income for the quarter was around USD 949 million, rising 2% yoy. This growth was fueled by a 7.3% increase in sales volume in Thailand’s food business, specifically pork, chicken and egg products. The agro and pet business also contributed to the rise.

Expanded production capacity supported this growth, enabling Betagro to meet higher demand from both domestic and international customers. However, selling prices declined, particularly for domestic pork, due to seasonal demand drops and labor shortages.

These temporary factors—linked to the rainy season and reduced Cambodian labor—are expected to improve in Q4 2025.

Gross profit rises on efficiency, input costs

Gross profit for Q3 stood at USD 142 million, rising 10.5% yoy. Meanwhile, gross profit margin improved to 15%, up from 13.9% in Q3 2024.

Lower raw material prices and enhanced production efficiency played key roles in the margin expansion. Betagro’s portfolio optimization, which focused on high-margin products and channels, further strengthened its profitability.

Strong nine months

From January to September 2025, the company generated revenue of USD 2.86 billion, up from USD 2.61 billion a year ago. Net income surged to USD 174.73 million compared to USD 45.80 million in the previous year.

A speculative buy

Finansia Syrus Securities has rated Betagro as a speculative buy, setting a target price of around USD 0.61 per share. This followed Q3 results that met analyst expectations, despite a 55% drop from the previous quarter.

Year-on-year, however, profit rose 19%, supported by growing sales volume and lower livestock farming costs. Finansia notes that these factors helped cushion the impact of falling pork prices.

Recent data showed pork prices rebounding in November 2025, rising from USD 1.72/kg to USD 1.97/kg after the annual vegetarian festival. This recovery is linked to reduced piglet supply and government stimulus efforts.

With pork prices expected to climb further, Betagro is well-positioned to benefit. Its ongoing share buyback program also supports investor confidence by limiting downside risk during market uncertainty.

Subscribe now to the technical pig magazine

AUTHORS

Bifet Gracia Farm & Nedap – Automated feeding in swine nurseries

The importance of Water on pig farms

Fernando Laguna Arán

Microbiota & Intestinal Barrier Integrity – Keys to Piglet Health

Alberto Morillo Alujas

Impact of Reducing Antibiotic use, the Dutch experience

Ron Bergevoet

The keys to successful Lactation in hyperprolific sows

Mercedes Sebastián Lafuente

Addressing the challenge of Management in Transition

Víctor Fernández Segundo

Dealing with the rise of Swine Dysentery

Roberto M. C. Guedes

Actinobacillus pleuropneumoniae – What are we dealing with?

Marcelo Gottschalk

The new era of Animal Welfare in Pig Production – Are we ready?

Antonio Velarde

Gut health in piglets – What can we do to measure and improve it?

Alberto Morillo Alujas

Interview with Cristina Massot – Animal Health in Europe after April 2021

Cristina Massot

Differential diagnosis of respiratory processes in pigs

Desirée Martín Jurado Gema Chacón Pérez