Oversupply in China’s pork sector is driving livestock prices to their lowest in years.

China’s pork industry is experiencing sharp price pressures despite record slaughter volumes, according to the Ministry of Agriculture and Rural Development. From January to June 2025, Chinese slaughterhouses processed 183.55 million pigs, up 14.5% year-on-year (yoy), ensuring abundant pork supplies but weighing heavily on livestock and meat prices.

Prices fall across the board

Live pig prices have fallen for six consecutive weeks, reaching 14.35 yuan/kg (USD 1.97/kg) in mid-August—down 31.4% from 2024. Pork prices followed a similar trajectory, dropping to 24.93 yuan/kg (USD 3.42/kg) in the third week of August, a 22% decline yoy.

Piglet prices have endured the longest slide, falling for 15 straight weeks to 33.25 yuan/kg (USD 4.56/kg), representing a 25.4% annual decline.

Profitability remains, but tightens

Despite falling prices, pig farming has stayed marginally profitable, thanks to historically low feed costs. Corn and soybean meal remain subdued, helping offset weaker livestock prices.

According to Zhu Zengyong, analyst at the Beijing Institute of Animal Husbandry and Veterinary Medicine, pig farming has remained profitable for 15 consecutive months. However, margins have narrowed significantly, with average farm profits dipping below 100 yuan (USD 13.70) per head in July.

Demand and market outlook

Domestic pork consumption remains subdued during the hot summer season, but analysts expect a recovery in September and a seasonal boost during jerky production in southern China in late November.

To stabilize prices, the National Development and Reform Commission (NDRC) has announced plans for a new round of frozen pork stockpiling, removing excess supply from the market.

On the trade front, China imported 626,000 tons of pork from January to July 2025, a 4.1% increase year-on-year, although July imports slipped 0.6%.

Looking ahead, analysts predict slight seasonal price increases but continued tight margins, with profitability expected to remain positive but constrained.

China remains the world’s largest pork producer and consumer, making its price movements and policy responses highly influential for global meat markets and feed demand.

Subscribe now to the technical pig magazine

AUTHORS

Bifet Gracia Farm & Nedap – Automated feeding in swine nurseries

The importance of Water on pig farms

Fernando Laguna Arán

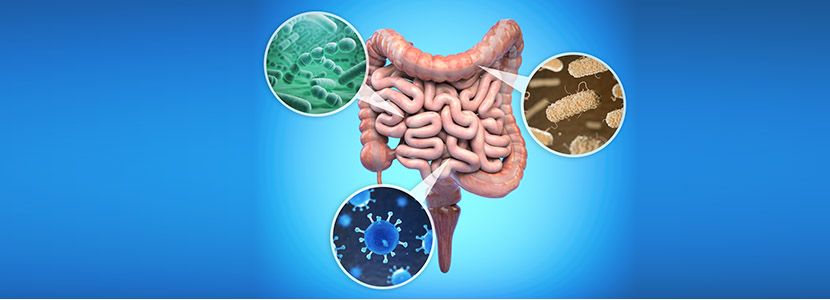

Microbiota & Intestinal Barrier Integrity – Keys to Piglet Health

Alberto Morillo Alujas

Impact of Reducing Antibiotic use, the Dutch experience

Ron Bergevoet

The keys to successful Lactation in hyperprolific sows

Mercedes Sebastián Lafuente

Addressing the challenge of Management in Transition

Víctor Fernández Segundo

Dealing with the rise of Swine Dysentery

Roberto M. C. Guedes

Actinobacillus pleuropneumoniae – What are we dealing with?

Marcelo Gottschalk

The new era of Animal Welfare in Pig Production – Are we ready?

Antonio Velarde

Gut health in piglets – What can we do to measure and improve it?

Alberto Morillo Alujas

Interview with Cristina Massot – Animal Health in Europe after April 2021

Cristina Massot

Differential diagnosis of respiratory processes in pigs

Desirée Martín Jurado Gema Chacón Pérez