Ministry of Finance clarifies that a product classified as animal feed is exempt from value-added tax (VAT) at all stages.

Cassava-processing enterprises in Vietnam have reported significant confusion over VAT rates applied to agricultural products, such as dried cassava pulp and dried cassava chips, used in animal feed.

Tax authorities have issued inconsistent guidance and imposed inconsistent rates: : 10% (currently reduced to 8% until December 31, 2026), 5%, or full exemption for the same type of goods.

Businesses said these inconsistencies complicate compliance and increase costs. They have asked for unified guidance to ensure fairness and predictability in tax obligations.

The Ministry of Finance clarified VAT rules based on existing laws.

These provisions highlight the overlap between exempt goods and those taxed at 5%, which has caused confusion among cassava enterprises.

To resolve uncertainty, the Ministry of Finance issued unified guidance on VAT application:

The Ministry encourages businesses to study the regulations to ensure accurate compliance and avoid tax penalties.

Subscribe now to the technical pig magazine

AUTHORS

Bifet Gracia Farm & Nedap – Automated feeding in swine nurseries

The importance of Water on pig farms

Fernando Laguna Arán

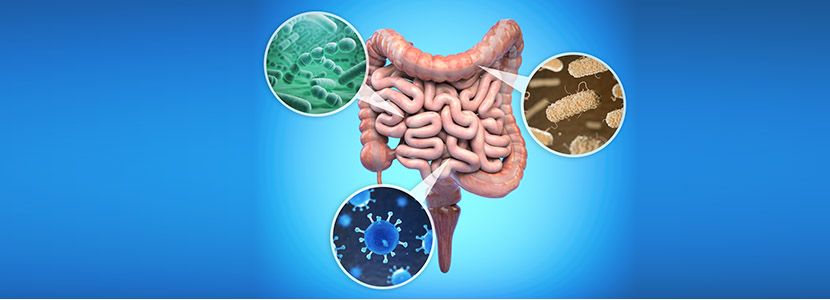

Microbiota & Intestinal Barrier Integrity – Keys to Piglet Health

Alberto Morillo Alujas

Impact of Reducing Antibiotic use, the Dutch experience

Ron Bergevoet

The keys to successful Lactation in hyperprolific sows

Mercedes Sebastián Lafuente

Addressing the challenge of Management in Transition

Víctor Fernández Segundo

Dealing with the rise of Swine Dysentery

Roberto M. C. Guedes

Actinobacillus pleuropneumoniae – What are we dealing with?

Marcelo Gottschalk

The new era of Animal Welfare in Pig Production – Are we ready?

Antonio Velarde

Gut health in piglets – What can we do to measure and improve it?

Alberto Morillo Alujas

Interview with Cristina Massot – Animal Health in Europe after April 2021

Cristina Massot

Differential diagnosis of respiratory processes in pigs

Desirée Martín Jurado Gema Chacón Pérez