China’s new anti-dumping tariffs on EU pork imports threaten margins, with offal exports most at risk.

European pork producers are facing renewed pressure after China imposed anti-dumping duties of up to 62.4% on imports of EU pork products. The provisional tariffs, effective this week, target more than USD 2 billion in annual exports, and threaten to erode margins across a sector that had only recently begun to recover from years of high feed and energy costs.

China is the EU’s largest pork export market, accounting for 25% of total shipments. Exports to China rose 4% in H1 2025, reversing a three-year decline. But the new duties, introduced after Beijing’s preliminary investigation found evidence of dumping, could force EU exporters to accept lower returns or risk losing market share to competitors.

Offal trade hit hardest

The tariffs strike hardest at the offal trade. Items like pig ears, noses, and feet—delicacies in China but with limited global demand—make up over 50% of EU pork exports to the country, according to Rabobank. With few alternative buyers, producers have limited options to redirect these volumes.

“Although trade will continue, downward pressure on EU pig prices is expected,” said Eva Gocsik, global animal protein strategist at Rabobank. She added that offal redirection to pet food markets offers only limited margins, while selling prime cuts to other destination could intensify competition.

Spanish exporters most vulnerable

Spain accounts for nearly half of EU pork exports to China, followed by the Netherlands, Denmark, and France. Spanish industry group Interporc and Denmark’s Agriculture & Food Council have pledged continued engagement with Chinese authorities during the investigation, which is expected to conclude in December.

Companies cooperating with the probe face duties of 15.6% to 32.7%, while others are hit with the maximum 62.4%.

Trade tensions rise

The move is widely viewed as retaliation against EU tariffs on Chinese electric vehicles, part of escalating trade tensions that have also drawn European brandy and dairy into the dispute. Analysts warn that Brazil, a low-cost pork producer, could seize the opportunity if approved to export offal to China.

With domestic Chinese supply currently elevated, Beijing’s actions also reflect efforts to curb imports. “They have too many pigs and demand is not there,” said Jean-Paul Simier, analyst at Cyclope. “This is also an opportunity to slow imports from Europe.”

Subscribe now to the technical pig magazine

AUTHORS

Bifet Gracia Farm & Nedap – Automated feeding in swine nurseries

The importance of Water on pig farms

Fernando Laguna Arán

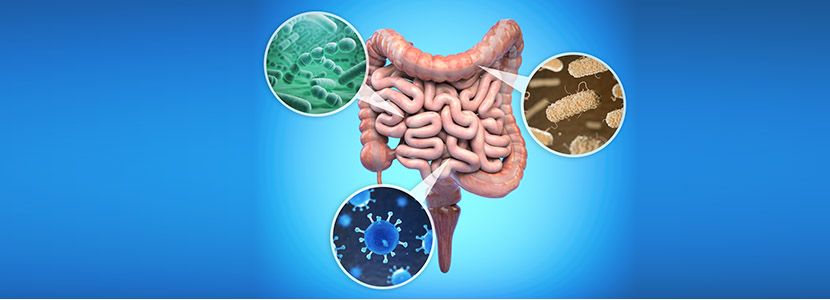

Microbiota & Intestinal Barrier Integrity – Keys to Piglet Health

Alberto Morillo Alujas

Impact of Reducing Antibiotic use, the Dutch experience

Ron Bergevoet

The keys to successful Lactation in hyperprolific sows

Mercedes Sebastián Lafuente

Addressing the challenge of Management in Transition

Víctor Fernández Segundo

Dealing with the rise of Swine Dysentery

Roberto M. C. Guedes

Actinobacillus pleuropneumoniae – What are we dealing with?

Marcelo Gottschalk

The new era of Animal Welfare in Pig Production – Are we ready?

Antonio Velarde

Gut health in piglets – What can we do to measure and improve it?

Alberto Morillo Alujas

Interview with Cristina Massot – Animal Health in Europe after April 2021

Cristina Massot

Differential diagnosis of respiratory processes in pigs

Desirée Martín Jurado Gema Chacón Pérez